nh food tax calculator

In Texas prescription medicine and food seeds are exempt from taxation. There are however several specific taxes levied on particular services or products.

Learn how to apply for assistance check eligibility track your application status and more.

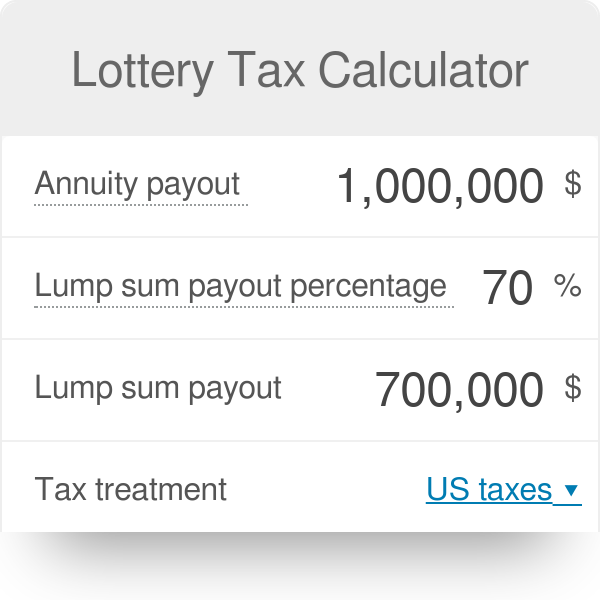

. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. New Hampshires sales tax rates for commonly exempted categories are listed below. Figure out your filing status.

You can use our New Hampshire Sales Tax Calculator to look up sales tax rates in New Hampshire by address zip code. Also check the sales tax rates in different states of the US. There have been important changes to the Child Tax Credit that will help many families receive advance payments.

Digital Media Manager. New hampshire salary tax calculator for the tax year 202122 you are able to use our new hampshire state tax calculator to calculate your total tax costs in the tax year 202122. Exact tax amount may vary for different items.

Unable to work for health reasons. Concord NH 03301 P 603-226-2170 F 603-226-2816. New Hampshire Hourly Paycheck Calculator.

Food Stamp Calculator Use the federal food stamp calculator to estimate the amount of benefits you may receive based on income expenses and family size. Advance Child Tax Credits ACTC payments are early IRS payments from the 50 percent of the estimated amount of the Child Tax Credit that you may claim on your 2021 tax return during the 2022 tax filing season. Some rates might be different in Portsmouth.

A 9 tax is also assessed on motor vehicle rentals. Census Bureau Number of cities that have local income taxes. NH EASY Gateway to Services New Hampshires Electronic Application System.

New Hampshire has a 0 statewide sales tax rate and does not allow local. A calculator to quickly and easily determine the tip sales tax and other details for a bill. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. For additional assistance please call the Department of Revenue Administration at 603 230-5920. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any.

For sales tax please visit our New. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for New Hampshire residents only. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income.

The ID Tax will be fully repealed on December 31 2026. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

378 South Main Street Laconia NH 03246. So the tax year 2021 will start from July 01 2020 to June 30 2021. New employers should use 27.

Granite Staters grabbing a bite to eat or staying in a hotel beginning Friday will see a little bit of relief moving forwardThe state meals and rooms tax is dropping from 9. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. You may be required to file New Hampshire business tax returns if your gross business income exceeds 50000.

The state has the right to adjust its rates quarterly so look out for notices to make sure you pay the right taxes each quarter. Enrolled half-time or less. Use our interactive calculator below to gain a better understanding of how your business can maximize its support of local community projects through the CDFA Tax Credit Program.

Free calculator to find the sales tax amountrate before tax price and after-tax price. Meals and Rentals Tax Monthly Activity Reports - compiled and published by the NH Office of Strategic Initiatives For an up-to-date list of. Are under age 18 or are age 50 or older.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Then 2 on after December 31 2025 and finally 1 for taxable periods ending on or after December 31 2026. Use this app to split bills when dining with friends or to verify costs of an individual purchase.

New Hampshire Paycheck Quick Facts. Last updated November 27 2020. New Hampshire income tax rate.

Vermont has a 6 general sales tax but an additional 10. 0 5 tax on interest and dividends Median household income. Work at least 20 hours a week in paid employment.

This New Hampshire hourly paycheck calculator is perfect for those who are paid on an hourly basis. Motor vehicle fees other than the Motor. Switch to New Hampshire salary calculator.

And all states differ in their enforcement of sales tax. Multiply this amount by 09 9 and enter the result on Line 2. New Hampshire is one of the few states with no statewide sales tax.

Switch to New Hampshire salary calculator. Calculating your New Hampshire state income tax is similar to the steps we listed on our Federal paycheck calculator. Designed for mobile and desktop clients.

New Hampshire Payroll Tax Calculator Best Recipes Recently Recipes. And remember to pay your state unemployment. Use this app to split bills when dining with friends or to verify costs of an individual purchase.

1 x standard forever stamp 1 x postcard stamp 1 x 10 stamp. New Hampshire Hourly Paycheck Calculator. Nh meals tax calculator.

For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year. New Hampshire is one of the few states with no statewide sales tax. Students attending an institution of higher education like college university tradetechnical school are typically not eligible for SNAP unless they meet one of the exemptions below.

Sales tax calculator for Texas United States in 2021. Since the focus of our income tax calculator is on normal employment income this Interest and Dividends Tax is not included in our calculations. 2022 New Hampshire state sales tax.

It is not a substitute for the advice of an accountant or other tax professional. It can also be calculated as 15 per 1000 total or 750 per 1000 for both buyers and sellers.

How To Calculate Monthly Sales Tax For A Restaurant

Don T Waste The Crumbs Real Food And Natural Living On A Real Budget Credit Card Debt Settlement Credit Card Payoff Plan Credit Card Debt Payoff

Arizona Sales Reverse Sales Tax Calculator Dremployee

Amazon Com Sharp El M335 10 Digit Extra Large Desktop Calculator With Currency Conversion Functions Tax Percent And Backspace Keys And A Large Angled Lcd Display Perfect For Home Or Office Use Office

2021 Mileage Reimbursement Calculator

Amazon Com One Huge Jumbo Calculator With Oversize Display Office Products

Pin On Converters Calculators Generators

Should You Move To A State With No Income Tax Forbes Advisor

Tax Dictionary Irs Collection Financial Standards H R Block

Your Data Entry Resume Is The Essential Marketing Key To Get The Job You Seek The Resume Including For The D Data Entry Clerk Job Resume Samples Sample Resume

How To Calculate Sales Tax Definition Formula Example

Stop Overspending For Good Overspending Frugal Personal Financial Planning

![]()

Snap Eligibility Calculator 50 State Food Stamp Prescreener

15921 Pocket Calculator With Hard Shell Flip Cover By Innovera Ivr15921 Ontimesupplies Com

How Remote Work Affects Your Taxes And Deductions You May Qualify For Real Simple

Sign Up To Get Investing Insights From The Pros Accredited Investor Investing Dividend Income

Want To Avoid High Taxes Retire In One Of These 10 States Retirement Money Choices Tax