mississippi state income tax 2021

Mississippis sales tax rate consists of a state tax 7 percent and local tax 007 percent. The tax rate reduction is as follows.

Printable Mississippi Income Tax Forms For Tax Year 2021

Mississippi state taxes 2021.

. Withholding Formula Mississippi Effective 2021. If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a. Information on Available Tax Credits.

Beginning with tax year 2018 the 3 income tax rate will be phased out over a five-year period. The Mississippi income tax rate for tax year 2021 is progressive from a low of 0 to a high of 5. 80-106 IndividualFiduciary Income Tax Voucher REPLACES THE 80-300 80-180 80-107 IncomeWithholding Tax Schedule 80-108 Itemized Deductions Schedule.

These back taxes forms can not longer be e-Filed. Mississippi State Income Tax Forms for Tax Year 2021 Jan. A downloadable PDF list of all available Individual Income Tax Forms.

The Mississippi Department of Archives and History MDAH administers the Mississippi state historic. Below are forms for prior Tax Years starting with 2020. 27 7 5 and 27 7 18.

Ad File 1040ez Free today for a faster refund. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. How to Print Paychecks with Stubs on Blank Stock.

11 injured as car crashes into food truck. Mississippi Resident Individual Income Tax Return 801052181000 2021. Taxpayer Blind Taxpayer Age 65 or Over Spouse Age 65 or Over Spouse Blind 7 Total number of dependents from line 6 and Form 80-491 12 Total line 10 plus line 11 9 Total.

Mississippi Income Tax Forms. West in SE front bedroom 542021. Mississippi state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MS tax rates of 0 3 4 and 5 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Senate Bill 2858 2016 Legislative Session Miss. The Mississippi tax rate and tax brackets are unchanged from last year. Beginning with tax year 2021.

Printable Mississippi state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. File With Confidence When You File With TurboTax. TaxFormFinder provides printable PDF copies of 37 current Mississippi income tax forms.

How to Calculate Federal Withholding Tax. Multiply the adjusted gross biweekly wages times 26 to obtain the annual. Photographs must also be numbered and keyed to floor plans of the building and site.

Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages. Additionally the 4 percent bracket includes 5000 of taxable income meaning potential savings would amount to a maximum of 200 per year for single and joint filers. DeSantis says Cold War could ensue between Florida and Georgia if.

Spouse First Name Initial. Details on how to only prepare and print a Mississippi 2021 Tax Return. Other things to know about Mississippi state taxes The state also collects taxes on cigarettes and.

19 rows Mississippi has a state income tax that ranges between 3 and 5 which is administered by the Mississippi Department of Revenue. MISSISSIPPI STATE INCOME TAX CREDIT. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

Detailed Mississippi state income tax rates and brackets are available on this page. Why the state income tax is not correct. The state income tax table can be found inside the Mississippi Form 80-105 instructions booklet.

The House voted in February to phase out Mississippis income tax cut the 7 grocery tax in half and increase several other taxes. Ad Receive you refund via direct deposit. In Mississippi the 4 percent bracket applies to workers earning approximately 13300already a very large portion of the labor force.

Latino and other analysts think an income tax repeal would signal to the rest of the country Mississippi is a pro-business state and encourage more economic development leading to job creation. Purchase Hunting Fishing License. Married - Filing Separate Returns 12000 Spouse SSN City ZipCounty Code Taxpayer First NameSSN.

Simplify Your Taxes And Your Life. Important tips to help expedite processing of your return. HISTORIC PRESERVATION CERTIFICATION APPLICATION INSTRUCTIONS.

In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Income and sales tax rates Sean Jackson 11122021.

If youre married filing taxes jointly theres a. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. 2021 Mississippi State Sales Tax Rates.

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. Submit a map of the. Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 Income Tax Regulations Title 35 Part III Mississippi Administrative Code.

Department of Revenue - State Tax Forms. Get Your Max Refund Today. Mississippi Income Tax Rate 2020 - 2021.

Renew Your Driver License. The list below details the localities in Mississippi with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Search Results related to ms income tax forms 2021 on Search Engine.

The sales tax on clothing and many other items would rise from 7. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan.

Tax Rates Exemptions Deductions Dor

Mississippi Tax Forms And Instructions For 2021 Form 80 105

State Corporate Income Tax Rates And Brackets Tax Foundation

Prepare Your 2021 2022 Mississippi State Taxes Online Now

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

Where S My Refund Mississippi H R Block

Mississippi Tax Rate H R Block

2022 Average Irs And State Tax Refund And Processing Times Aving To Invest

State Income Tax Rates Highest Lowest 2021 Changes

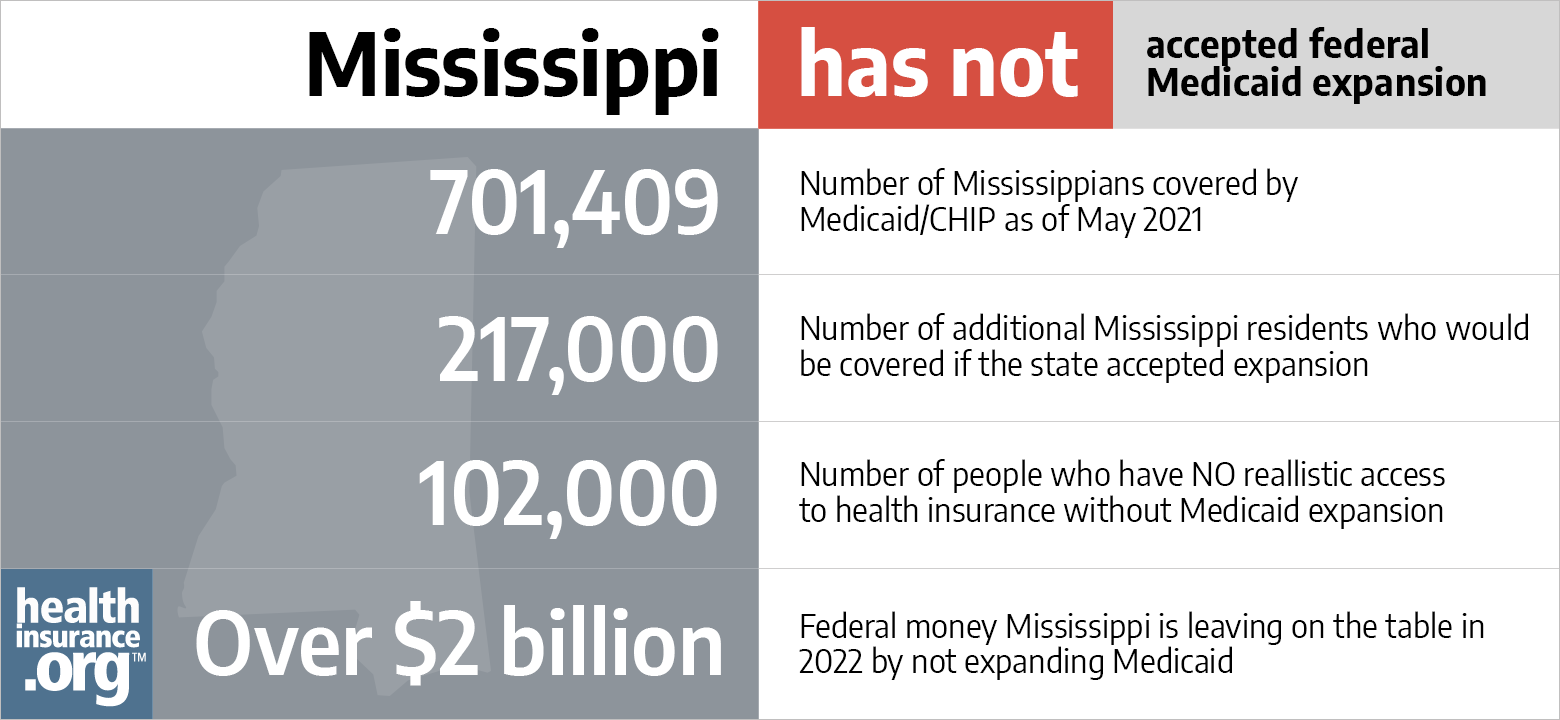

Aca Medicaid Expansion In Mississippi Updated 2022 Guide Healthinsurance Org

How Do State And Local Individual Income Taxes Work Tax Policy Center

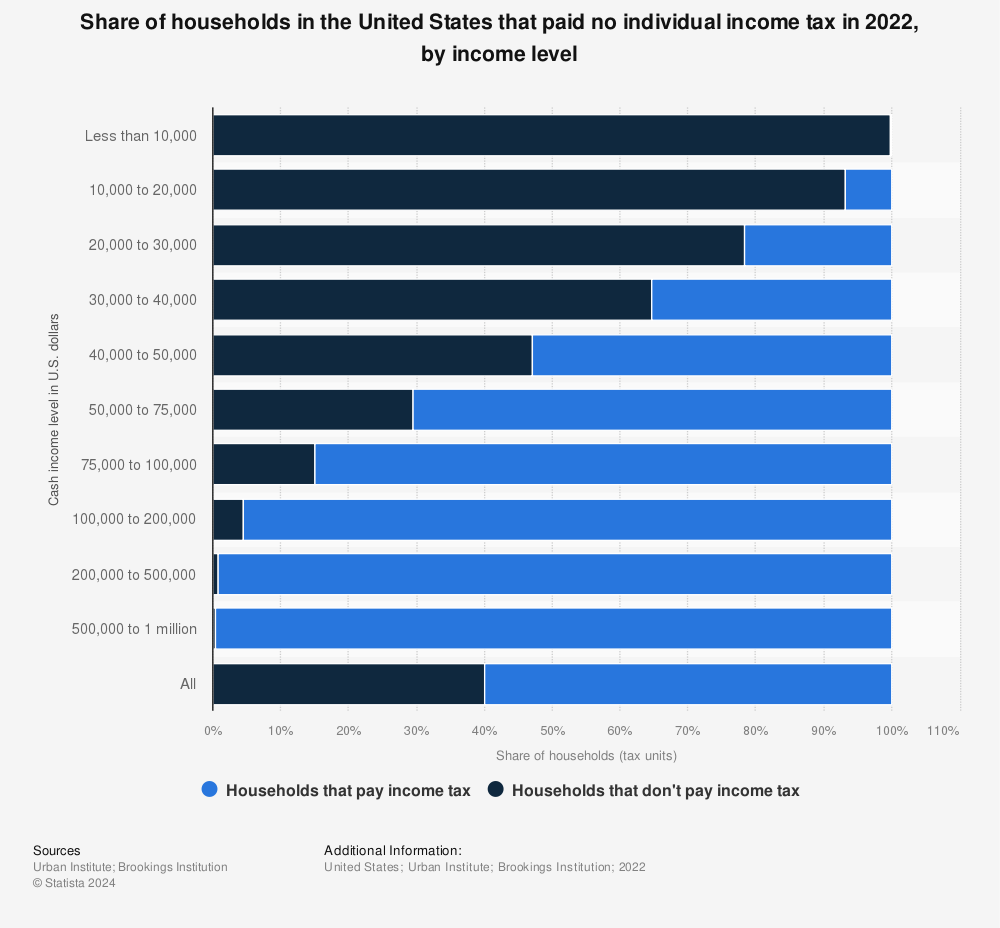

Percentages Of U S Households That Paid No Income Tax By Income Level 2021 Statista

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Which States Pay The Most Federal Taxes Moneyrates

States With Highest And Lowest Sales Tax Rates

Tax Rates Exemptions Deductions Dor